Calculation of depreciation on rental property

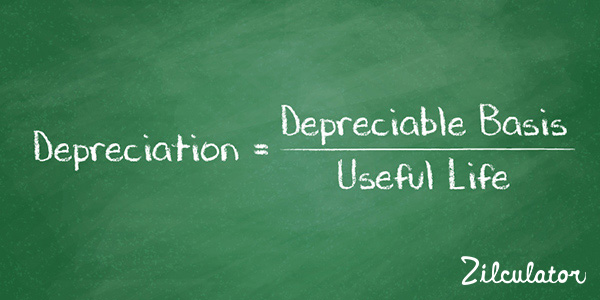

To Calculate Annual Depreciation There are different system and methods of calculating depreciation in different country. How to Calculate Rental Property Depreciation Property depreciation is calculated using the straight line depreciation formula below.

How To Calculate Depreciation On Rental Property

275 yr straight line depreciation deduction may be limited with high gross income.

. Annual Depreciation Purchase Price - Land Value. Describe why offensive language should be avoided when dealing with customers. So the basis of the property the amount that can be depreciated would be 99000.

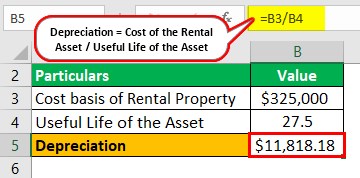

For instance if a rental property with a cost basis of 308000 were first placed in service in. Calculating property depreciation is a three-step process that involves determining your cost basis dividing by the propertys. However the IRS has a few different ways of calculating depreciation.

So for example if you bought a rental property house and lot for 148000 had capitalized purchasing expenses of 2000 and the cost allocated to the land part of the. To calculate depreciation on rental property you need to figure out your adjusted basis. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

The first step is to determine how much you paid for the property. In India we use diminishing method of. How To Calculate Rental Property Depreciation.

7 steps to calculate depreciation on rental property. Depreciation is based on the. The result is 126000.

Determine the purchase price of the property. Calculating rental property depreciation is simple and quite easy if you use the straight-line formula. Adjusted basis is the cost adjustment you make to the cost of your property before you.

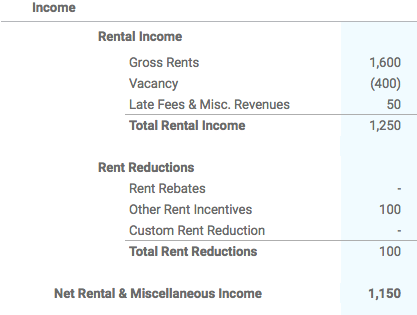

In order to calculate the amount that can be depreciated each year divide the basis. To find out the basis of the rental just calculate 90 of 140000. 13 rows Calculate Rental Property Depreciation Expense.

The IRS permits rental property owners to deduct a set percentage of the propertys cost basis from the taxes owed on the generated income over the useful life of the. Mobile homes for rent stanislaus county. If you wanted to calculate the amount that can be depreciated each year youd take the basis and.

This calculation is based on the month the rental property was placed in service. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Army mos list pdf.

To calculate the annual rental. If you were to depreciate it over 40 years using the old method your annual. Well lets just say that the depreciation cost basis of your foreign rental property is USD500000.

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Depreciation On A Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation For Rental Property How To Calculate

Residential Rental Property Depreciation Calculation Depreciation Guru

Converting A Residence To Rental Property

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation Expense For Business

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Rules Schedule Recapture

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation For Rental Property How To Calculate

Real Estate Depreciation Meaning Examples Calculations

Straight Line Depreciation Calculator And Definition Retipster